Create a brand people love from someone who does it for a living.

I will say this until undertakers shovel gravel and dirt over my face — data is directional, but definitive. Data is your tour guide, your backstage pass, and the operator’s manual you instantly trash when you unpack IKEA furniture or complex appliances. The power in data is how you use it, how you mine for insights, ferret out meaning from noise, and put the insights that matter most into practice.

After having multiple rage blackouts over faux marketers and bloggers telling you how to build brands while getting basic terminology wrong, I penned an epic eight-piece tutorial on how to build a brand. It took me a month to write and two kidneys. The tutorial won a slew of clients and my work is often taught in business schools and MBA programs including Northwestern and Purdue.

But I firmly believe complacency is the death of curiosity. We do it this way because it’s always been done. [Shudders and shrieks on the level of Michael Meyers.]

While the methodology I shared still holds, my approach is different. Of course, a brand platform includes the basic building blocks: vision, mission, values, positioning and purpose, brand and product benefits and reason to believe, story, and verbal identity (i.e., personality, voice, and tone), but now the final deliverable isn’t the star of the show — the pre-game is. Let me explain.

I used to start every project with my 3C analysis. I examine my client’s company, customers, and competitors to not only understand the context for the brand I’m architecting, but to dive deeper into the customer and brand opportunity. For me, competitors are only relevant in providing information not emulation. Competitors reveal my client’s missteps and opportunities. However, the data I gathered was primarily owned data from the client in the form of customer segmentations, CRM reports, website and social analytics, paid media and performance marketing analysis, and the list goes on. I’d supplement that with my own mostly qualitative read on the industry, competitors, and customers.

And it worked — clients got smarter and brand building had direction. Until my need to keep curious and receptivity to people’s input changed me completely.

For years, I’ve worked with one senior analyst on all my projects. She works full-time at one of the fancy New York global agencies — a place where I served as VP of Strategy for a few years — but does segmentation analysis for me on the sly. This woman is a genius. She’s way younger than me, smart, and understands how marketers like me think and devises ways of using data to drive story in a way I’ve seen few analysts think.

This year, I’ve had two major clients. One of which is a turnaround rebrand for a heritage company that’s a household name in their category. First, I held brand workshops to help them think differently (or at the very least give them fresh perspective), which turned into a brand platform project, which morphed into a project that changed how I build brands. The project was a standard brand perception and equity study. I’d done them while working agency-side, but not as a consultant.

Now, I had the freedom to do it my way.

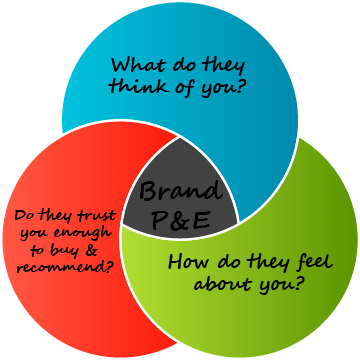

What’s Perception & Equity? 🔗

Brand perception reveals what consumers think & feel about your competitors’ brands. Brand equity is the level of trust they have in any new offerings. Is your brand strong and valued enough prevent them from bolting?

Consider perception the real estate your brand owns in the minds of your customers and how it compares to your competitors. What do they think, feel, and do when it comes to your brand, and how deep is that relationship that they’ll trust in buying into new products, lines, and extensions? There are four factors involved in perception analysis:

- Cognitive — Ideas or concepts your customer associates with your brand.

- Emotional — How they feel about your brand.

- Language — How they describe your brand.

- Action — The experiences they have with your brand.

You need to know the strength of your brand to determine its equity. Equity is the perceived worth of your brand — it’s why people buy your brand over another; it’s why they’ll pay more. Consider the equity Apple holds in the minds of their customers. If you love and trust Apple products, you’re more likely to buy them even if other brands offer comparable products. Equity is composed of:

- Brand awareness, recall and perception: How your customers know, recognize, and what they think/feel/do when it comes to your brand.

- Positive or negative experiences and belief system: The totality of experiences a consumer has buying from you, the perceived quality and value of your products, and their preferences.

As a result, they’ll assign tangible (they’ll buy it) and intangible (they’ll tell their friends to buy it) values to existing and new products.

A standard equity study includes stakeholder interviews, customer interviews (voice-of-customer research) and surveys. Of course, I blame my obsessive nature to excavate and be a contrarian, as I knew there was a way we can go deeper — I just didn’t know how to do it.

So, I emailed my analyst to get her insights and she proposed adding NLP analysis to the mix and performing scattertext analysis on the 45-minute employee interviews (using transcripts) and the 30–45 minute calls I had with my client’s customers. Along the way, we decided to include search analysis because I’m fixated on the gap between what customers say they do (and the performance that comes with it because people want to present their best selves, even if it’s in a survey) and what they actually do (search and connecting that data with Google Analytics data to discern path to purchase and roadblocks along the way).

We built this methodology and analysis structure on the fly because I wanted a definitive answer to two questions:

- How does this customer think, buy, and behave when it comes to my client’s brand?

- How does that behavior shift when they encounter other brands in the category?

A few simple questions often drives my analysis and while I’ll go in with a theory, the data is an objective person in the room validating or refuting what I think. While I was engaged to do this study to build my client’s product portfolio and architecture, it got me thinking this is a better way to build brands. Let me explain.

Your customers will tell you how you’re perceived and where you fit in the market. I’m the customer, founders and execs often say without realizing they may well be the customer, but with a fuck-ton of bias and too much at stake to be truly objective.

Payroll has a funny way of clouding vision.

We’re often beholden to what a company believes how its customers think, buy, and behave instead of actually talking to customers. I’ve seen so many founders act like they’re Steve Jobs without the vision. And while Steve Jobs was a large-time asshole, he did what few could: understood what customers wanted before they wanted it. A trait (and an arrogant one at that) few people possess but everyone seems to think is ubiquitous. They know more than their customer — they’re smarter. [Heaves sigh]

They gamble and employ epic guesswork, but your brand isn’t Vegas and your house doesn’t always win. You know who’s winning? The brands that actually listen to their customers, really listen, instead of waiting for their turn to speak, explain, and defend. I’ve had to tell clients to shut up during customer calls because the customer is the star of the show and the brand isn’t a lawyer trying to win over a jury.

Brand building becomes a subjective exercise predicated by the emotions of executives instead of the voice of their customers. I wanted an approach that would be that referee, an objective voice sitting between consultant and client. So, here’s my new approach to building brands.

Step 1. Start With Brand’s Owned Data 🔗

I’ve penned an exhaustive article on how to perform discovery, so I won’t regurgitate that here. The idea is you’re collecting data that touches a customer at various points in their journey with a brand. Whether it be:

- Social data (demographics) and social listening to understand what customers are talking about as it relates to the product, brand, and category. Or…

- Website/search data to understand purchase intent, path to purchase, and more details about a customer. Or…

- Performance marketing to understand what messaging resonates with customers. What pain points are they responding to? What benefits and outcomes make them salivate? What’s turning them off? Or…

- Segmentation studies and customer research that’s meant to unpack demographics, psychographics, ethnographic data, and buying behavior so we have deeper insight on how customers think, buy, and behave. Or…

- CRM (customer relationship management) data or CSR (customer service representative) reports that diagnose problems, define trends, and allow us to define when a customer is vulnerable, upset, or over-the-moon delirious.

Or any other data that gives us information and insights into what customers think about the brand and products sold, and how much they value them, used to be the crux of my analysis. Now, it’s step one.

Step 2. Use NLP to Understand What Customers Are Saying — How, When, and Where They’re Saying It 🔗

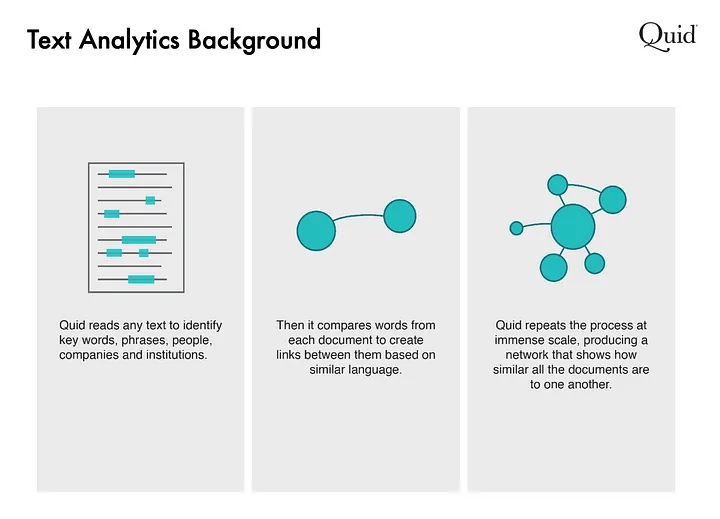

NLP is a subfield of linguistics, computer science, and artificial intelligence concerned with the interactions between computers and human language, specifically it’s a mechanism of programming computers to process and analyze large volumes of natural language (like speech & text) data.

NLP isn’t social listening because we’re not simply looking at what customers are talking about. We’re observing top clusters (or groups) of conversations, sub-clusters, the relationships between clusters and sub-clusters conversations, and the language/semantics/sentiment related to those conversations. NLP has helped me tactically pull together phrases, words, emotions, and challenges for composing positioning statements, benefit and outcome language, and a brand’s story. NLP reveals what matters most to customers.

Let me be clear — I’m not a data analyst, but I’m sharing how my analyst approached this analysis for two of my clients and how I’ll use in brand building moving forward. We sought to:

- Define how people perceive my client, their products, in context of the category.

- Define how my client’s competitors (and products) are perceived and valued by their customers. Does my client enter any of those conversations, when, why, and in what context?

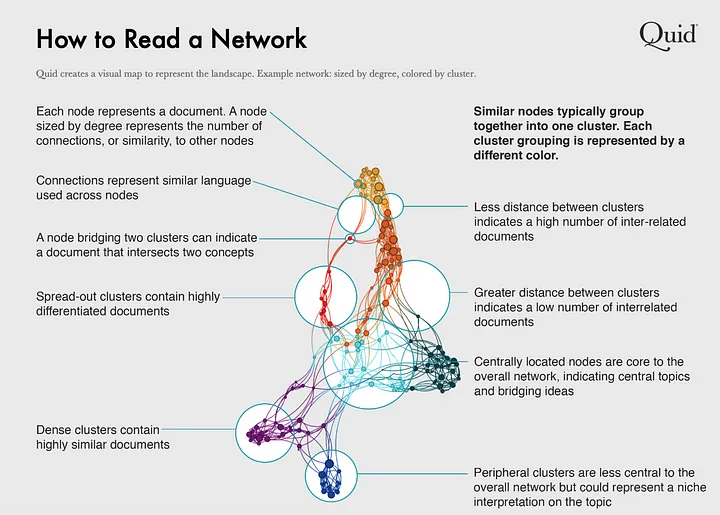

For both analyses, my analyst used Quid, an AI tool that combines search and high-performance algorithms to find patterns in data and displays them visually. We distilled a minimum of 10,000 pieces of content over 1–3 years. We clustered each data set based on the top topics people were talking about. Then, we examined the top sub-clusters within each topic to understand how closely the topics related to one another linguistically, the conversations consumers were having, and the sentiment related to those conversations.

I got a spreadsheet of all the customer verbatims, which excites me because there’s nothing more I enjoy on a Friday night than diving into Microsoft Excel.

What I love about NLP is the agility of it. For example, a recent competitor survey (i.e., we used SurveyMonkey to find customers of our competitors to pick their proverbial brain) revealed that two of my client’s competitors weren’t a fan of my client’s social media channels. Since we didn’t know why, I asked my analyst if we can go in and key in our client and social media to determine top conversations. It’s a backdoor way to gauge a general understanding when you can’t have follow-up conversations on a question or topic, or if you want to go deeper on a specific category, conversation, or topic.

NLP also helped me understand not only the customer journey (i.e., the steps a person takes when they buy a product), but their product journey, and it allowed me to fuse the two to go deeper in messaging and marketing. What I love about NLP is it lacks the performance customers tend to act out when they’re being surveyed by a brand or talk face-to-face with them. What we reveal when typing on a keyboard is often more honest and real than what we say to a brand. Makes sense, right? We’re more open when talking to our peers than perceived authority.

It’s this season why I wanted to pair NLP with Search Analysis to determine the degrees of difference (especially when you throw in surveys and VOC research) between what’s said and what’s done.

Step 3. Perform Search Analysis to Uncover a Customer’s Search, Discovery, Research, and Purchase Journey 🔗

Using Google Keyword Planner and other related tools, I had two analysts (my main data analyst and a search expert) pull data from the past 2–3 years on my client, the products they sell (and plan to launch), and competitor data.

We examined & assessed the following:

- My client’s organic performance and growth opportunities over a one-year period, as well as 3–5 year trends. We explored top topics and related search behavior. We then reconciled this with the client’s Google Analytics data.

- Competitors, by category. One-year for all competitors and 3–5 year trends for the top 3 competitors.

- Purchase intent (whole & percentages) for top brands in the my client’s category.

- Top-line funnel analysis of a customer’s conversion path via search.

What was powerful about search analysis was how it revealed my client’s value and equity in the category, which competitors were on its heels, and even gave us insight into pain-points (helping us create brand and product messaging) and customer preferences. For example, a client of mine was considering a line of wellness teas and we drilled down to the top flavors we should be offering. So, the search wasn’t only helpful for insights that drive brand development, but also product development and brand/performance marketing. All of this leads me to the following —

I want to deliver research that wasn’t a pretty deck that collected dust. I wanted my work to have legs beyond the original project mandate. How does research earn its keep? It informs strategy and gives tactical direction. My deliverable not only helped define and shape my client’s rebrand, but it was a tool used by the sales team, product development, marketing, and customer care. The analysis answered:

- What products should we develop? What are customers buying? What are they clamoring for? What specific features are required? This analysis helped reshape the product pipeline and prioritize launches that would be more impactful.

- What messaging resonates with consumers? What are their challenges, what solutions are they looking for, and what outcomes do they expect? We not only used these insights in our rebrand, but also shared them with the agency developing the client’s new website and copy for the website. It also informed messaging for performance marketing.

- What do customers value in the products they buy and the brands they buy them from?

- Who are category leaders, why, how are they winning, and where are they falling short? This was useful for arming the sales team with real, objective data they can present to retail accounts. Their viability and growth potential in the category and using that data to create predictive revenue models for in-store and online accounts.

Search and NLP distill complexity and volume to simplicity. We have an objective, definitive snapshot of the market, competitors, and customers. Once you have a grasp of the landscape, it’s now important to zoom into the details. This is where talking to customers comes into play.

Step 4. Talk to Your Customers With Voice-of Customer Research 🔗

Voice of Customer research allows us to go deeper in understanding how a customer thinks, buys, and behaves as it pertains to a brand and its products. One way we facilitate VOC (voice of customers) is through customer long-form interviews.

The objective of VOC research is to hear customers in their own words, and we use those words in not only structuring and packaging a product portfolio, but also as a means to effectively market and message customers. This is an excellent, brief article on why so many companies miss the mark re: VOC research.

Typically, I conduct a maximum of twenty Zoom interviews, 30–45 minutes with a participation incentive. In advance, it’s smart to share an NDA, but to also relay to customers that the interview is for research purposes only. The shadiest fucking thing you can do is turn around and use the interview, customer likeness, etc., in marketing. Do not be a fool. Do not do this. What makes for a powerful interview are three things:

Shut up 🔗

This is about the customer. Ask your questions and let them go where they need to go. Don’t guide, suggest, or redirect because you’re inserting bias. Now, we’re human and there’s an element of bias and performance, but the idea here is you want to avoid influencing how your customer thinks, buys, and behaves because in the real world you’re not whispering in their ear in a store aisle or while they’re browsing online.

We can clarify questions with technical information or facts, but we can’t pitch them or convince them, since this wouldn’t reflect how they would make decisions “in real life.” Remember, your role is to observe and document.

Give them the lay of the land 🔗

What you’re about to talk about, any housekeeping and disclaimers. Here’s an example of an opening I used in a recent VOC interview:

Ask open-ended questions 🔗

Avoid questions that box them in to a yes or no answer. Use How, Why, When, What starters. Use “tell me about…” You want to get your customers talking and don’t be afraid to ask follow-up questions for clarity. I always find that the more conversational the interview is and the more you’re human with your customer, the more revealing and insightful the conversation will be.

So, yes, you have to keep in mind the bias factor and the no leading element, but talk to customers like you would connect with people at a party who hear where you work and have thoughts about the products your company makes and sells.

Now, after the interview is when the magic begins. My analyst provided the following for two recent studies, which documents her approach to the analysis.

Mechanics 🔗

After collecting the raw data, we ran some basic NLP cleaning steps, which may include but not limited to, parsing, tokenization, stop word removal, lemmatizing/stemming, etc. After an initial data cleaning, we ran tagging per transcript to include bigram, top verbs, top adjectives, subjectivity scoring and sentiment scoring.

Based on the range of the sentiment score for the client’s brand, we decided on the cutoff point to split the transcript into two sets to run a scattertext analysis. The goal for scattertext analysis is to identify commonalities and differences between people who have more positive vs. more neutral/negative point of view for the brand.

Analysis Structure 🔗

The analysis was divided into four major parts. Part one was a brief summary of the participants’ basic demographics. Part two will center on the brand’s current brand perception and product experience. Part three will focus on major competitor brands that appeared in the conversation and product experience. Part four closed on customers’ future/alternative product interest.

Step 5. Perform Stakeholder Interviews in the Same Format 🔗

Stakeholder interviews are more important than you think. Consider the people on the front lines who engage with your customers on a daily basis. They not only have valuable intel, but they also are the people who embody your brand. Consider the receptionist when you first walk into an office, or the customer service representative on the phone — first impressions, especially when you’re vulnerable, are vital. Employees are the people who can win customers over and back to the brand, and they’re also megaphoners for your company.

Typically, I speak to a cross-section of employees across tenure. People often make the mistake of talking solely to senior leadership, which is ridiculous and myopic. Junior talent is often closer to customers and they offer vital insights into their behavior. I don’t care if you’re an intern or the CEO — all perspectives are important to give a realistic point-of-view of internal brand perception, customer interactions and experience, and how they’re prepared for a brand pivot or evolution. Stakeholder interviews are also an excellent way to determine what challenges you’ll face along the way to prepare for those challenges.

Because the worse thing you can do is rebrand and your employees are confused, pissed, befuddled, and ill-equipped to be brand advocates.

For my interviews, I used the same approach and analysis for VOC.

Step 6: Customer Surveys Are Still Relevant, So Get Over Yourself 🔗

It blows my mind when people tell me surveys are irrelevant. Yes, if that’s the sole piece of customer research you have… sure, that’s problematic. Because while VOC allows us to go deeper in conversation and understand nuance and complexity, surveys give us a broader view of brand perception and equity — especially when complemented by NLP, search, and a client’s owned data.

I’m a huge fan of SurveyMonkey, since it reduces the amount of data cleaning my analyst has to do, and the format is user-friendly. Typically, we incentivize and survey a minimum of 500 customers to not only ensure statistical significance, but to also get a broader cross-section of customers. You can solicit customers from your email list, social media, etc.

For a perception and equity study, I divide the survey into four parts:

- General customer profile: Basic demographics, product preferences and usage, and buying behavior (how, when, how frequently, and where they buy).

- Discovery and adoption of the brand: I’m determining how they learned about the brand, what they value from the brand and products that impact purchasing behavior, and who influences purchasing decisions (e.g., friends and family, social media, advertising, influencers, ratings and reviews, etc.). You want to know how they found and why they buy. This is also a place where I get competitor intel to evaluate how they compare brands and what elements made them choose our client.

- Brand perception: What do customers think, feel, and do when it comes to the brand and products. You’re gauging product efficacy, value for money, packaging and marketing perception, customer experience, and why they keep buying from a brand. I also want to know what would cause them to switch (or churn). I use a mix of multiple choice and open-ended questions so I can get broader intel but get the details in their own words.

- Brand equity: Would customers recommend the brand and products to trusted peers? Would they buy into new products, new and adjacent categories? How much trust do they have in a brand and what they offer to keep buying from them and recommend them.

After the survey, my analyst goes deep into parsing the data and creating a general picture of a brand’s perception and equity based on the below process. My job is to pull all the insights from various sources to tell a cohesive, concise, and compelling story.

Mechanics 🔗

After exporting the raw data from SurveyMonkey, my analyst split the data into numeric data input vs. text input. For the numeric data, she generated results and create visuals in tableau. For the text data, she generated word clouds, bigram/top adjectives/top verbs for each of the open-ended questions.

Analysis Structure 🔗

Our analysis broke down into our client and competitor brand insights. For our client, there were multiple chart groups (within tableau) around consumer demographics, category insights, current brand perception (strengths and areas of improvement), and future product interest. For competitor brands, there was a ranking of all competitors mentioned in the survey and major brand perception for the top 3~5 brands.

Ultimately, this study drove a follow-up study into our client’s top three competitors to understand equity and perception and what would it take to switch to our client’s products.

Let’s Get Back to Brand Building, Shall We? 🔗

You may be thinking I’m a bushel of bananas to do all this work before building a brand platform. Well, my friend, you’re living in the land of short-term gratification while I believe in playing the long game. While I dial elements of the six steps down for brand platform building, the methodology is incredibly valuable not only for developing a brand, but understanding tactically how to message, market, and develop products for that brand.

The discovery analysis is actionable document that has value beyond the scope of a single project. Of course, the research isn’t one and done, and sure you have to keep talking to your customers, but for brands that need to get a handle on their brand, know their customers better, or are really falling to pieces when it comes to marketing and messaging that doesn’t seem to break through the noise, this new approach is an invaluable tool.

Also, it makes brand building easy. The research, as well as a client’s input, gives me a clear path forward in terms of how to build the core brand elements to not only reflect how companies want to be perceived, but it’s balanced by what customers actually want and need from a brand. Subjectivity and objectivity are in balance.

I’m no longer wading through the dark.

What If I Don’t Have All This Fancy Technology? 🔗

GOOD QUESTION. Listen, I’m a team of two. I’m not a fancy agency — I’m a smart, experienced marketer with an analyst who puts my heart on pause with her genius. Surveys and talking to your customers aren’t expensive — just time and resource intensive. But well worth it. Google Keyword Planner is a free tool and you can hire a freelance search pro to generate insights and make connections. They’re not a million dollars, mon amies.

Finally, yes, you need Quid, an enterprise software to perform NLP, but you can start with social listening. Spend time in the communities, comments, and social networks your prospects and customers are engaged in. Pour over the emails and feedback you get in social media. Spy on your competitors’ platforms and see how they engage with customers and questions customers routinely ask. And while you won’t get the same insights from analyzing large volumes of data, it’s a start to knowing how your customers talk about you, your category, and your competitors.

Your customers will tell you how to build your brand, how to market and message your products. All you need to do is shut up and listen.