Research and analysis of your customer, competitors, and company are the backbone for developing a brand.

Before a case goes to trial, lawyers embark on a fact-finding mission known as discovery. The procedure marks the gathering and analysis of all the information an attorney needs before they walk into a courtroom. Discovery typically includes sifting through a mountain of paperwork, doing research on similar cases, and conducting interviews. Without getting a handle on the background and all the facts, how could a lawyer effectively try a case?

When you’re in the early stages of building a brand, the process is similar except for the fact that we don’t lock founders in an airless, dark room while a hulking interrogator shines a blinding light on their face in hopes of getting the perp to fold under questioning. Or it’s entirely possible that I’ve watched too many episodes of CSI.

Creating a brand requires information. Information gives you context, direction, and an informed point of view. It lets you define where you stand and where you fit. Information removes the blindfold from your eyes, so you don’t have to Bird Box your way through the brand-building process. You need information about your business, the industry you’re in, and the customers you want to serve. Back in the day, you paid consulting firms to corral all the research and deliver a neat PowerPoint presentation for the low, low price of $50K. Or you sat for days in the local library or Small Business Association office to gather as much as you could to build a brand. And while you still may be outsourcing your research or doing the literal legwork, the internet and social media give us access to a tsunami of data and resources.

Respected research firms like Pew, IBIS World, Statista, Nielsen, Comscore, and Econsultancy share free industry reports and customer research online; some even offer paid upgrades, for those who want to go deep in their discovery. You can purchase studies in nearly every sector or segment of the population from Forrester, Mintel, and eMarketer, to name a few. You can source information from trade publications and market-specific research outfits. You can analyze your social media, website, CRM, email marketing, and PPC campaigns. You can access millions of people through SurveyMonkey’s audience tool if you want to gather real-time customer information or pilot brand messaging and creative.

Data is predictive and directional. It helps orient you in the context of your industry’s size and health, direct and adjacent competitors, and your customers’ needs, wants, lifestyles, and preferences. Data aids in your decision-making, but the ultimate test is market and campaign performance and the insights you gather to refine and optimize your marketing and messaging. Data, experience, and the willingness to be agile are the key components of building an effective and healthy brand.

Collecting intel on your market, competitors, and customers coupled with an analysis of your business and what you bring to the table will lay the foundation for your brand. Many founders bypass this critical step or take shortcuts in favor of flashy creative and tactics. They want to launch yesterday, not sift through data points, market analysis, customer behavior, and trends. But a tagline, product beauty shot, and a press run won’t guarantee you’ll convert and retain customers.

Get it right from the jump so you can avoid costly mistakes down the pike. Get to know your customer, industry, and — more importantly — your company.

Know Your Customer 🔗

It’s important to get laser-focused on the customer you want to target. Your focus will drive the periphery and repel customers who aren’t a fit for your brand. Also, if you’re focused on targeting everyone, your content becomes generic and diluted and you’re not honing in on the behaviors, consumables, motivations, and pain points of your specific audience.

You likely have one ideal customer who aligns with your brand and multiple subsegments of customers to reflect critical aspects of your business or brand portfolio.

Let’s say you’re a company in the athletic apparel business. Ideally, you want to target people who have a lifestyle that requires the use of your products, they’re in the income range to buy your products, and there may be other demographic and psychographic factors that help you home in on your ideal customer. However, you always want to be as specific as possible when it comes to targeting. If you have products that are designed for men, you’ll refine that ideal customer. Say you sell products for men who cycle outdoors, you’re going to drill down even further.

Maybe you create products that target hardcore runners and newbies across genders, which is the difference between people who start running on the treadmill on January 2 and someone who reads running magazines and travels for marathons. The customer profiles, behaviors, needs, and wants could be demonstrably different. If you sell different products meant to target different kinds of people, you have to create a customer map for each of those products; those submaps ladder up to the overall master customer profile.

Keep in mind that your ideal customer profile may refine over time. Right now, you’re in the nascent stage of your brand/business, and you may find you have to evolve and improve your profile as the brand and business develops. What matters now is to start from a relatively specific place that you can optimize and grow from. The objective is to define the limits of a particular group and burrow deep inside that group. Here’s what you want to know when you’re burrowing:

Demographic Information 🔗

This is data that tells you who’s buying your product. You want to start by learning the basic characteristics of your customers, including age, gender, race, ethnicity, income, marital status, geography, education, profession, and occupation.

Behavioral Information 🔗

This is data that shows you how your customer is buying your product. Behavioral analysis is an all-encompassing view of how your customer interacts with your sector, products, and competition. When do they purchase? How are they buying, and how often? What channels (i.e., smartphone, desktop, in-store, catalog, etc.) do they use for purchase?

Transactional Information 🔗

This is specific data that demonstrates what your customer is buying.

Psychographic Information 🔗

For this data, you’re moving away from demographics and dealing with personality, values, attitudes and opinions, interests, and habits. (For extracurricular reading, this great piece goes into psychographics in detail.) You’re going beyond the surface to get inside their hearts and heads

- Habits: What media are they consuming (i.e., books, magazines, TV, radio, websites, games, social media, online and mobile entertainment, etc.)? What are their hobbies?

- Attitudes: What’s their view of your industry, products, and competitors? How was this view formed?

- Motivation: What event or series of events drives them to your product? What is their “why”?

- Influences: Who do they trust? What sites do they visit for information validating your product and promise? What platforms or kinds of people influence their decision-making?

- Pain points: What are their challenges or obstacles that pertain to your product and service through the entire buying process (i.e., from encountering your product to post-purchase and use)?

How do you compile all the information you need about your customer? Look at the data from your site traffic, visits and repeat visits, remarketing, PPC campaigns, email and CRM data, social media, and marketing campaigns. Look at any traditional, digital, or social ads you may have run and the resulting insights. Gather any general market or customer research and view those insights in the context of your own data. Survey your customers and prospective customers.

Many companies perform what’s known as customer or audience segmentation, which is a detailed customer analysis and persona formulation. Segmentation is based on primary research (i.e., focus groups, polls, surveys with a mix of open and close-ended questions, in-person or phone interviews, and observations) and/or secondary research (i.e., industry news and literature, government and nongovernmental agencies, nonprofits, academic institutions and research centers, commercial third-party studies and analysis, websites, social networks, and internal resources). In primary research, you get information directly from your consumer; with secondary research, you depend on a third-party or existing data.

How to Perform Primary Research 🔗

- Define your objective. What are you looking to learn? What do you know? Try to be as specific as possible.

- Map out your methodology and all associated logistics. How will you conduct your research? What form will it take? How will you source participants? How long will it take?

- Develop your questions. You want a mixture of closed and open-ended questions so you can get definitive insights with colorful commentary.

- Conduct your research. Depending on the method you choose, you will coordinate all the pregame logistics and start your study. (I’m deliberately vague here because there could be a whole course just on primary research; this is just the basics.) For example, let’s say you want to survey 10,000 people who have purchased your product in the last six months. You decide to use SurveyMonkey and buy participants based on predefined criteria. The qualifying question for participation will be the screening question, which guarantees all the respondents have purchased your product. You set up your SurveyMonkey profile, coordinate all the related admin and costs, draft your questions and log them into SurveyMonkey, purchase your participant pool and time frame (i.e., start and end date), and you’re off and running.

- Collect and segment the data. Regardless of your methodology, you’ll get a set of raw data. You want to collect all the respondent data and assemble and segment it based on the format of your questionnaire and how you want the responses represented.

- Analyze the results. Did you get the answers you were looking for? Did the research get you a step closer to better know your audience? Did you uncover new questions and insights into the process that require further study?

Advantages of Primary Research 🔗

With primary research, you have complete control over the questions you ask and information you collect and use based on the needs of your business or organization. Because there’s complete transparency in how the research is formulated and conducted, you get raw data. This means you won’t have to deal with diluted or “massaged” results. In other words, you’re getting insights directly from the people you want to target without filter or spin. In addition, you’ll get more of the qualitative information that is sometimes critical in humanizing your customers. You get more of a sense of your subject when they’re empowered to speak or write freely.

Disadvantages of Primary Research 🔗

Primary research is time-consuming and expensive. Setting aside all the logistics of getting a group of people into your office for a focus group, consider the collection, assortment, analysis, and segmenting of online surveys — especially if you have a large sample size (i.e., lots of people have answered your survey). You not only need the resources to fund the setup of your primary research, you also need the resources to synthesize and make sense of the results in a way you can use in your brand development, marketing, and messaging efforts.

Sometimes, one study isn’t enough. Never rely on a single data source to drive material decisions for a company. You want to gather a confluence of data from myriad sources to gain the most objective, non-biased insights.

How to Perform Secondary Research 🔗

- Define the objective. What are you looking to learn? What do you know? Try to be as specific as possible. For example: smartphone usage of college students in India.

- Determine your research resources. You want to make sure you’re getting information from reputable and respected resources, i.e.,

www.bangingresearchsresults.commay not be your best bet. - Gather the data. Whether you’re pulling internal reports or hunting online, pool all your data in one place.

- Compare and contrast the results. You’re looking for consistent themes and trends and also intriguing outliers.

- Analyze to obtain essential insights. Did you get the answers you were looking for? Did the research get you a step closer to understanding more about your audience? Did you uncover new questions and insights into the process that require further study?

Pro tip: You can use Google alerts, YouTube, and Amazon to get intel on your customer on an ongoing basis.

Advantages of Secondary Research 🔗

With secondary research, information is quick, inexpensive, and easily accessible. You can scrape information on the web/social networks using open APIs and pull internal data faster than conducting a full-blown research study without the hefty price tag.

It’s an excellent supplement to primary research. In an ideal world, use primary research to validate and secondary research to refine. Pulling information from a variety of sources can create a clear picture of your customer.

Disadvantages of Secondary Research 🔗

As the Rolling Stones so sagely sang, “You can’t always get what you want.” With secondary research, it’s more challenging to pinpoint the exact questions you want to pose based on the specifics of your business, product, and target customer. Secondary research provides an excellent general big picture, but can lose some of the fine details. There’s also a lack of transparency. You may not always know the underlying objectives of a study and its framing and positioning, so you may get skewed results depending on who was surveyed, the questions asked, the collection and analysis methodologies used, etc. You’re getting the fully-baked sausage, but you don’t always know all the details on how it’s made. Timeliness might also be subject to question. Are you getting the most recent statistics? Our world is changing so fast that a study from 2014 may be completely irrelevant for your purposes.

Once you’ve accessed and analyzed all your data and formed your insights, it’s time to create living, breathing profiles for your customers. Your end product can be as complex as a customer segmentation or as simple as a customer insight profile. My customer insight profile template (MS Word document ) can help.

Segmentation is complicated, and I won’t be covering the how-tos here, but I will share some excellent resources I found on the topic:

- CGAP pulled together a superb how-to (PDF) that’s not bogged down in marketing jargon. This Wharton tutorial is heady for the layman, but it provides the essentials if you can plow through it and stay awake.

- You can purchase Harvard Business Review’s excellent tutorial on segmentation and targeting ($40). They also publish free articles and case studies on the topic accessible via search.

- Brandon Gaille’s simple segmentation best practices.

- There’s a great starter article from Brandwatch on segmentation basics. This one is terrific as well, and offers up some supplemental resources.

- A primer on micro-segmentation strategy: “Six Ways to Segment Your Audience You Haven’t Thought of Yet”

I’m also sharing some slides from a segmentation study I conducted for a client using primary and secondary research.

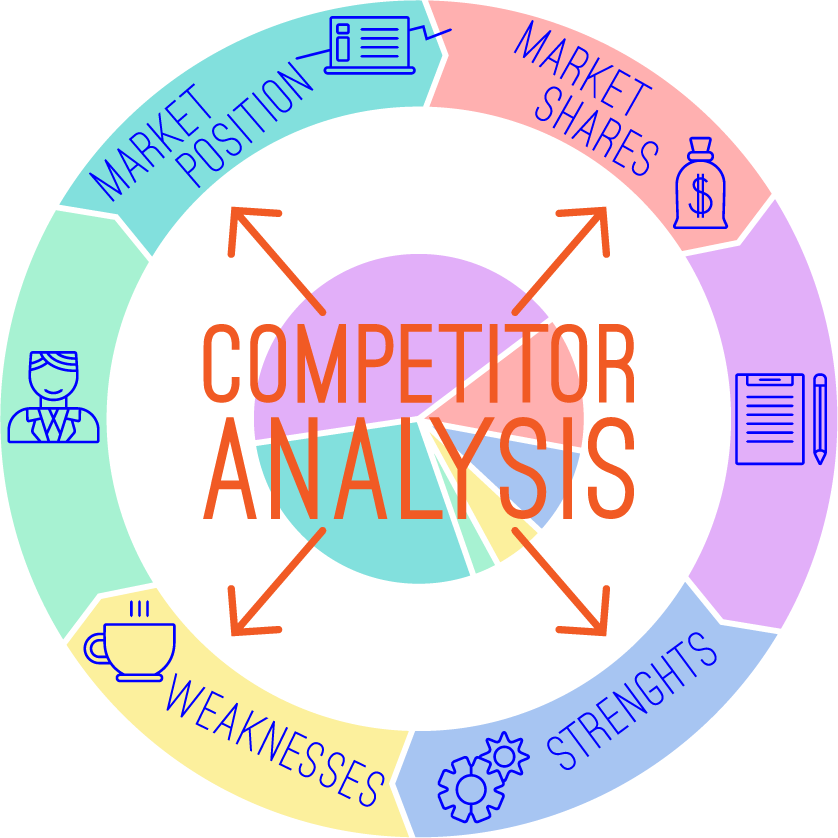

Know Your Competitors 🔗

Context is crucial, and you have to define your place in your industry to build a brand and be competitive. You want to have a general understanding of your industry’s size, health, growth, and trends to determine where you fit. No brand is created in a vacuum.

In the overview tutorial, I outlined the questions you need to ask when evaluating market conditions. Today, we’re going to home in on how you can keep close tabs on the competition. I like to create a formal competitor review where I evaluate players from a strategic standpoint, then track their tactical campaigns and movements as a result of the strategies in place.

How to Formulate a Competitor Analysis 🔗

- Create a list of direct and indirect competitors. So you don’t overwhelm yourself, focus on the top three-five, the companies that have substantial share or dominance or are poised to blow up. Check out Owler, an online community-based competitive insights platform that houses a treasure trove of information on over 12 million companies.

- Establish your assessment criteria and evaluate what makes them distinct. Consider all aspects of their brand and business; a competitive analysis encapsulates so much more than the products a company offers. We live in an age of abundant choice, and consumers are finally in the driver’s seat (PDF), providing businesses with real-time feedback. They demand personalization, customization, localization, relevance, agility, value, utility, and purpose — online and off.

Ask the important questions: Is it the products they sell or how and where they sell them? Is it the way they communicate with, and care for, their customers? Is it about their vision, mission, and values? Is it the way they market themselves? Is it the kind of content they create, how they form and distribute it? Is it how they use data to inform business and brand decisions? Is it their R&D or lean towards product or industry innovation?

Outline their offerings: products, services, features, benefits, and pricing strategy.

Define their positioning. What sets them apart from the pack? What unique qualities do they bring to the table?

Research their brand tone, voice, personality, and energy from a verbal and visual standpoint. What’s their vibe online? How do they connect and engage with their customers? How do they talk about their products? If they were a person, what character traits would they have?

Assess their content and channel strategy. What types and forms of content are they creating, and where are they distributing them? Which social and digital platforms are they on and are they effective?

Think about the tech: What kinds of tech do they utilize and employ? Mobile, VR, AR, A.I., chatbots, chat, text, etc.?

How do they manage customer service? What are their trial, sales/subscriptions, and return processes?

Do they have loyalty, referral, or retention programs?

Perform a SWOT analysis.

Use screenshots, scraped data from open APIs, scour forums, blogs, websites, social media feeds, and reviews. Remember, this is an evaluation of how the brands project themselves and their customers’ perception and response.

This free competitor analysis template (XLS) can get you started. Once you formally analyze other players, you can set up a spreadsheet to track their tactical campaigns on an ongoing basis. Here are some items you could track:

- Product pipeline and launches

- Special offers, sales, and deals

- Website traffic and performance (You can use a resource like Alexa’s Overlap Tool, which shows you sites that compete for similar audiences and SimilarWeb offers insights into traffic and sources.)

- Mobile applications

- Earnings, shareholder meetings, and reports for public companies

- Key employee hires and departures

- Marketing strategies and tactical campaigns across paid, owned, earned, and partner media (Mailcharts is an excellent tool if you want to keep tabs on your competitors’ email marketing campaigns.)

- SEM/SEO performance (Spyfu is a great tool for tracking your competitors’ keywords and ad campaigns for organic and paid search.)

- Any PR or online blowups or crises

- Content strategy across their owned properties, e.g., website, email, social media (Buzzsumo gives you serious intel on your competitors’ content and velocity.)

- Brand and influencer partnerships

- Press features, quotes, mentions, and guest articles in leading trade publications

- Category awards and “best of” or “top” lists

- Speaking events and panel features

Additional Resources 🔗

- Here’s a paper on competitive analysis penned by professor John Czepiel at NYU Stern School of Business

- Crobox’s “How to find psychographic data and turn it into customer intelligence”

- Brian Clark explains how creating a “minimum viable audience” could be the key to business success

- MIT OpenCourseWare offers many free online course materials on business, management, and marketing. Check out their marketing strategy, marketing management: analytics, frameworks, and applications and marketing management, and the analytics edge courses.

- This is a monster list of the best online tools you can use

- 50 template ideas

- CB Insights offers extensive competitive and market analysis for startups

- Great article on creating a competitive examination for SaaS companies

Know Your Company 🔗

The hardest part of building a brand is sitting down and being honest about your business. The discovery process is not only about amassing as much external information and resources as you can; it’s also an invitation to turn inward — your brand is bigger than the products you sell. It’s your reason for being, the memorable impression you’re determined to make, and, as Velveeta (cheesy) as it sounds, it’s the heart, mind, and soul of your business and a direct reflection of your customer.

In the overview tutorial, I shared three exercises you can use to immerse yourself in your business. The answers to those questions, in the context of your market and customer research, will serve as the foundation for your elevator pitch, story, positioning, benefits, reason to believe, and your character.

Now is the time for clarity and alignment, so do the exercises with your executive team and road test your message with your existing and prospective customers to collect their initial feedback. You’ll be surprised how much you learn when you informally talk about your business with people and gauge their perception and responses. You can use SurveyMonkey to concept test your brand message, products, and new product ideas, visual identity, and more to see what resonates. Concept testing also gives you a powerful, objective third-party perspective for those who are too close to their business, giving feedback from the people you want to sell to.

Now that you’ve completed your fact-finding mission, let’s get to the good stuff: storytelling.