In puzzles, there is clarity.

The Evolution of Token accruing value of the world physical assets — allowing people to own assets in a digital space. Tokens accrue its economic value within its ecosystem, while its price discovery is the displayed value in the secondary market. Token Design Framework is capped within the Economic Design Framework of an ecosystem.

Exploring Tokenomics 🔗

The primary functions of a token are categorized as SUMS.

- Security

- Utility

- Money

- Stable tokens (peg token)

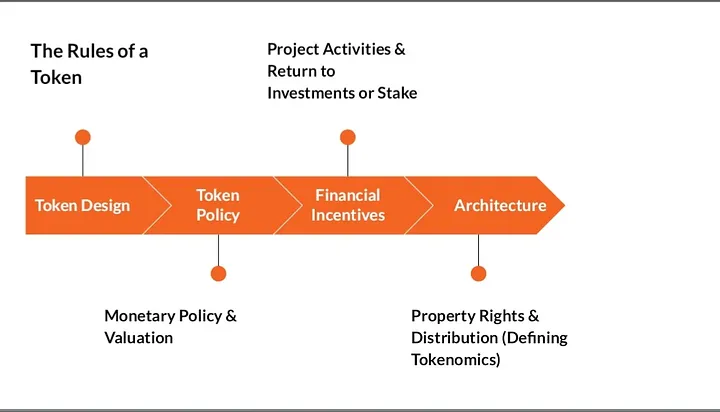

In DeFi, one of the fundamental metrics of determining a solid project is valuing its Token Economics. To understand Token Economics, we need to review the Token Design Structure of the framework:

- Token Policy

- Financial Incentives

- Architecture

Token Design is the rule of the token itself. These rules are defined in the smart contracts with code. Rule changes as the project grows or the ecosystem integrates a new form of transactional activity.

Token Policy 🔗

Reviewing the Monetary Policy and the valuation accrued to a token, the monetary policy of a token is designed from:

- Token Use Case

- The Token Function

- project’s Business Model.

If your token has a currency that is vulnerable to external forces such as stable coins, the Monetary Policy approach follows the Central Bank policy approach. If a token represents a claim to a certain asset on or off chain, bonding curves is the monetary policy reviewed. It defines the price as a function of the token supply. If the token is a utility to access the network, the monetary policy depends on its use case. A token that facilitates transactions as a currency is reviewed through the traditional monetary policy models — Monetary policy instruments.

Token Valuation is reviewed within the entire ecosystem. It determines how a token is priced. The token valuation answers the questions:

- How funds value a specific start-up

- How token derive their value when designing economics

- Value through transaction fees or Arbitrage, etc.

- The Growth if the project and the ecosystem

Token Design 🔗

The valuation model used are:

- Dynamic Price Equilibrium

- Dynamic Adoption

As a basis of understanding Token valuation, we review Bonding Curves. Bonding Curves is a curve that connect two variables. For Example;

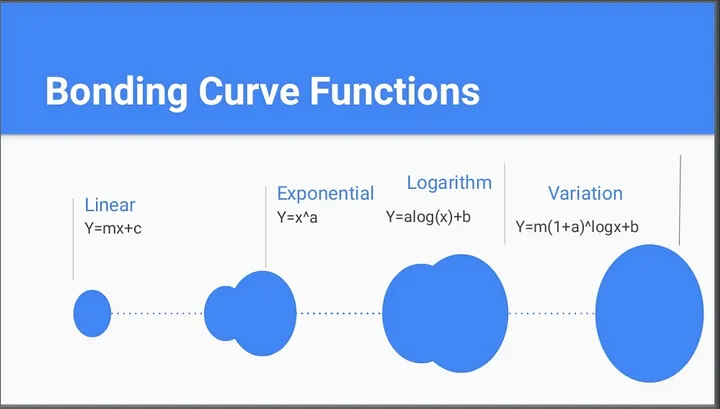

All of the above are determined mathematically embedded in a smart contract code. In a pool, via Automated Market Makers, a bonding curve is the smart contract executed to create a market for tokens without order books.

Bonding Curve use-cases:

-

What: Bonding Contract creates the market for tokens

-

How: it shows the formula functions governed by smart contracts. This exhibits how variables are determined in the charts

-

Why: Factors such as fundraising, liquidity provisions and curation market are considered.

Bonding curve is also used to mitigate risks. Bonding curves are a mechanism for pricing tokens that are used in token design. They are a mathematical function that determines the price of a token based on the token’s supply. A bonding curve is a continuous function that maps the number of tokens in circulation to the price of the token.

Bonding curves are used to determine the price of tokens in a decentralized market. They are used in decentralized exchanges, such as Uniswap, to determine the price of tokens. Bonding curves are also used to price tokens in token sales, such as initial coin offerings (ICOs), security token offerings (STOs), and initial DEX offerings (IDOs).

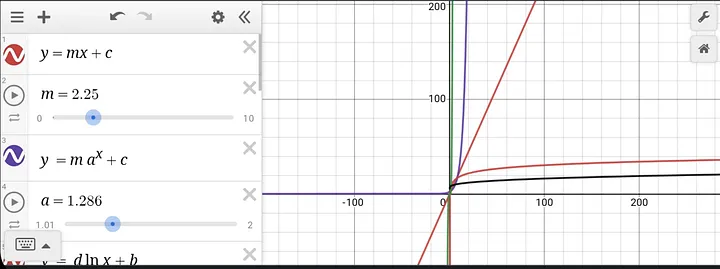

A bonding curve is defined by a mathematical function, which is typically a power law or an exponential function. The power law bonding curve is defined by the following equation:

Where $P(x)$ is the price of the token, $x$ is the number of tokens in circulation, $a$ is a constant representing the initial price of the token, and $b$ is a constant that determines the shape of the curve. The exponent $b$ determines the slope of the curve, and therefore the rate at which the price of the token increases as the supply increases.

The exponential bonding curve is defined by the following equation:

where $P(x)$ is the price of the token, $x$ is the number of tokens in circulation, $a$ is a constant representing the initial price of the token, and $b$ is a constant that determines the rate of increase in the price of the token as the supply increases.

Both the power law and exponential bonding curves are used to model the relationship between the token price and the token supply. Bonding curves have several important properties that affect the token design:

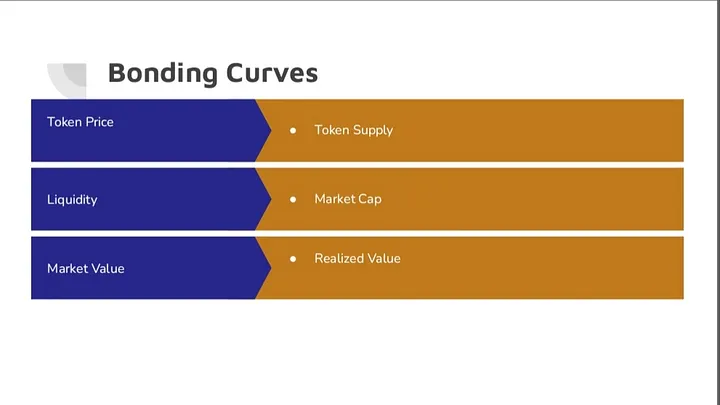

Token price & token supply: The bonding curve determines the price of the token based on the token supply. As the token supply increases, the price of the token increases according to the shape of the curve. This means that the token price is directly related to the token supply.

Where:

A power law bonding curve has a curve constant, c, which determines how the curve behaves. A smaller c results in a curve that is more linear, while a larger c results in a curve that is more exponential.

Liquidity & market cap: The bonding curve determines the amount of liquidity available in the market. The liquidity is proportional to the area under the curve, which represents the total value of the tokens in circulation. The market capitalization of the token is also proportional to the area under the curve. This means that the bonding curve determines the market capitalization of the token.

The formula for liquidity is:

Market value & realized value: The bonding curve determines the market value of the token, which is the price at which the token is trading on the market. The realized value of the token is the value of the token as determined by the bonding curve. The realized value is the amount of liquidity available in the market, and represents the maximum value that can be obtained by selling the tokens on the market.

The market cap of a token can be calculated by multiplying the token price by the total token supply:

The market value of a token represents the current value of the token on the open market. This value can differ from the token’s market cap due to differences in supply and demand:

The realized value of a token takes into account the price at which all tokens were last moved. This value represents the total value of the token that has been moved recently:

Where:

Bonding curves can be used to design tokens that have unique properties, such as low volatility or low inflation. For example, a token with a bonding curve that has a high exponent will have low inflation, since the price of the token will increase rapidly as the token supply increases.

In a Decentralized Exchange Pool, the above diagram is redefined as follows:

- The Constant Sum Market Maker — Linear

- The Constant Product Market Maker — Exponential

- The Constant Mean Market Maker — Cob Douglas/Logarithmic functions

- Stableswap Invariant — Variation

The Constant Sum Market Maker explains arbitrage opportunities. While the Constant Product Market Maker explains the demand and supply theory and so on.

Bonding Curve is divided into Augmented Bonding Curve (ABC) and the Dynamic Bonding Curve (DBC). Token in the pools are divided into liquid-token and the reserve-token. A combination of both is regarded as a relay-token.

Cake/BNB combines the reserve-token and the liquid-token together to form a Relay Token. The Relay token generally provides an avenue for staking, price spillage, and reduction in the Relay.

Mathematics of Token Valuation 🔗

Where:

Other mathematic valuation models include:

- Cost payable to purchase tokens in the reserve token

- liquid-token price

- Reserve Ratio

- Changes in conversion of liquid tokens

- New cost payable

All of these valuation model mathematics are derived using differentiation (dy/dx) methods within a range of values. Chain rule, for example, is used to derive the ration token formula.

Financial Incentives 🔗

One of the practical reasons for creating a token is that: “It aligns to incentivize various utilizers”. Money is capable of doing this, however, there are diverse participants overcrowding the space. An ecosystem or project token can achieve incentive alignment via several mechanisms.

Financial incentive is divided into Platform Activities and Return on Investments or Stake.

The platform activities defines the utilities a project is set to provide. A P2E incentivize it’s utilizers via gaming, insurance protocols such as Bancor incentivize via Impermanent Loss insurance.

The second variable is the ROI. Return on investment comes in various forms:

- Yield Farming

- Staking

- Exchanges in the secondary market

- arbitrage of liquid token prices

- etc.

Architecture 🔗

The Architecture of the Token Design is the major research model for fundamental labels. It involves two variables:

- Property Rights

- Distribution

This architecture explains the structure of a token. It describes the analysis of the token economics. The TVL, Market Capitalization, Tokenomics, and many more. Here, we are reviewing the Tokenomics.

Tokenomics 🔗

Tokenomics is derived from two words “token” and “economics”. It is the study of the supply and demand of a token reviewing its qualities, production and distribution measures. Below are the fundamentals studied in Tokenomics:

- cost of service

- token model

- network metrics

- operating revenue

- effect of network growth

- deriving value from utility

- operating cost

The above fundamentals are deciphered into the following processes.

Supply 🔗

In traditional economics, the supply of goods is the number of goods produced at a particular period of time. The available goods are directed to market to meet demand. In crypto-economics, Tokenomics supply describes the total amount of tokens available in production. A token supply is divided into:

- Circulating Supply: This is the number of tokens in circulation at a particular period of time. They are the tokens currently owned by people. It is important to note that not all tokens are being traded or used. There are lost tokens, unclaimed tokens, locked tokens and tokens in the deep cold storage. All of these are measured for token capitalization in On-Chain Analysis.

- Maximum Supply: The maximum supply of a token is the maximum number of tokens that can ever exist. The Avalanche token (Avax) has a maximum supply of $720,000,000. Here, it is also important to research if the max supply is fixed or not.

- Total Supply: The total supply of a token indicates the total amount of a token issued. It is not necessarily tokens in circulation. It also includes Burned tokens and locked tokens.

The Tokenomics is a perfect metric for analyzing the supply and demand of a token.

- If an asset is scarce, and there is a rise in demand for it, appreciation is speculated.

- No maximum supply lead to abundance of the token in the market and a decrease in price (Not necessarily). Other factors affect price such as the emission rates, etc.

- Once locked up tokens are released into the market, they affect the price of a token.

Above are determinants in evaluating the supply of a token.

Burning 🥵 🔗

Have you ever burned a currency note? After burning what happens? A burned resources can never be restored. That is the principle of nature. In Decentralized Finance, burning occurs for these reasons:

- To decrease the number of tokens in circulation

- To adjust supply and demand

- To make assets (tokens) less inflationary

Just like the basic characteristics of money and what makes money valuable is scarcity, tokens are made less demanding to create a scarce pool via burns causing a less inflationary asset. All burned tokens are transferred into a null address 0x0000000000000000000000000000000000000000. They cannot be withdrawn, nor do they have value. A token creator or a DEV creates a null address for burned tokens. It is significant to note that there are several measures for token burns.

Example 🔗

When an individual transfers a BSC token to an ERC wallet address or vice versa, it won’t reach its destination but rather be sent to a null address. Token burnt!

HODL rewards 🔗

It’s worth noting that burning tokens can also be used as a way to reward token holders. In some cases, projects will burn a certain percentage of the transaction fees collected and distribute the remaining fees to token holders. This creates an incentive for holders to hold onto their tokens and can also decrease the overall supply of tokens, increasing their scarcity and potentially their value.

Goal based 🔗

Additionally, some projects use token burning as a way to achieve a specific goal or milestone. For example, a project may decide to burn a certain percentage of their tokens once they reach a certain market cap or achieve a certain level of adoption. This can create a sense of excitement and momentum around the project and potentially increase demand for the token.

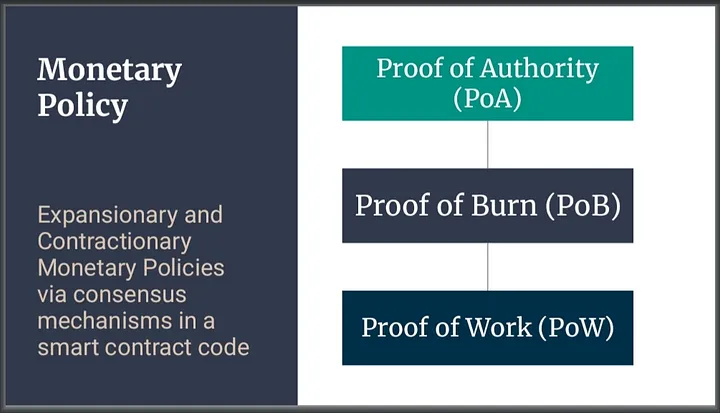

Monetary Policy 🔗

In Web3, Decentralized Finance tokens operate its monetary policy as follows:

- Is the token inflationary or deflationary? Never should you forget that monetary policy is a measure for hedging against inflation. Same applies to tokens.

- What are the plans for the token issuance in the future? (Vesting schedule.)

Inflation rates of a token is derived from liquidity mining programs that awards users with new tokens entering the circulating supply on a daily basis. This increases its sell pressure. Thus, token inflation decreases its purchasing power. Token inflation is caused by:

- Unlimited and continuous token issuance or emissions

- The appearance of too many projects. Supply rising while market cap remains constant.

- Mining: Increases the number of tokens held for miners.

- Staking: Increases the token supply, decreases the token value.

The basis of monetary policy for any project in an ecosystem is the consensus mechanisms of such projects (related to the source code). Here’s a short list of mechanisms:

- Proof of Authority (PoA)

- Proof of Burn (PoB)

- Proof of Capacity (PoC)

- Proof of Developer (PoD)

- Proof of Donation.

- Proof of Elasped-Time — Nodes.

- Proof of Liquidity.

- Proof of Replication — Data Storage Mining

- Proof of Spacetime.

- Proof of Stake (PoS) — Validating transactions or blocks

- Proof of Work (PoW) — Each block is mined by individuals or nodes on the network

All these monetary policy ideas are automated by code.

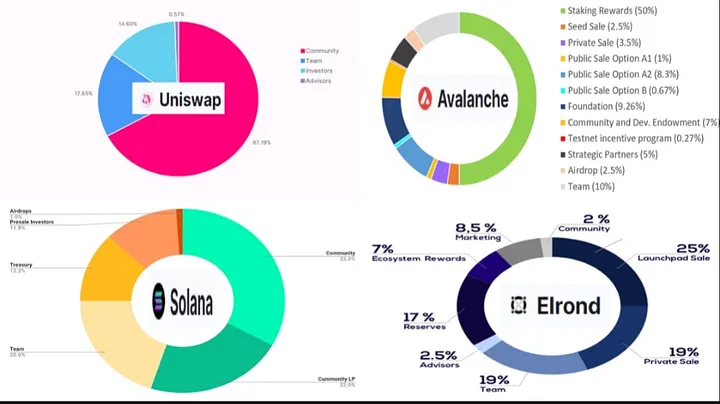

Distribution 🔗

Token distribution refers to the division of the total token supply into segments to maintain a stable growth process. To understand Tokenomics, asking the below questions about token distribution is important:

- How initially was the token distributed? (Pre-mining, IDOs, etc.)

- What percentage of the token supply are owned by the founders, developers, and partners?

- What minimum percentage can public investors own?

- What percentage are locked-up for future distributions?

- If a percentage is locked up from 4 above, what is the plan for the future distribution. That is what is their vesting schedule plan?

- Are there whales holding the majority share of the tokens? What percentage?

- Is there a possibility that a whale would sell off it’s token and manipulate the market?

The above questions are Tokenomics research questions that guide you towards determining a solid project in the ecosystem. There are two basic models for token distribution;

- Paid Model (Token sold for money)

- Free Model (Token distributed free of charge)

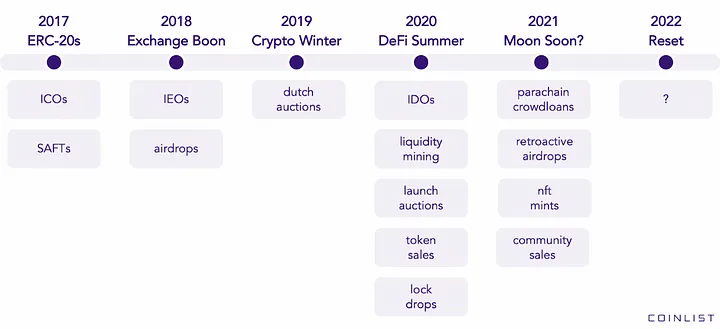

Paid Models is a method of token distribution from:

- The investor token tool (SAFT, Private Token Sale and other old methods)

- From the community pool (Launchpads, Public Token sale, etc.).

Free Models is method of token distribution from the founder’s team pool. They include;

- Token transfer from founders, token incentive scheme for team and advisors.

- Distribution of tokens from the community pool (Airdrops, Staking, Yield rewards, etc.)

The above diagram explains the Token Distribution Model right from innovation. The ICOs and SAFTs were in motion from 2013 through 2017. Another model not added is the Protocol Owned Liquidity model pioneered by Olympus DAO through Bonding Curve mechanism. The Voting Escrow model was also introduced by Curve Finance in 2020. It had been famous since then.

The fifth process of Tokenomics fundamentals that aligns with the Financial incentive Token Design is EARNING. It is a natural phenomenon by which projects share benefits or profits with stakeholders. The reasons are:

- to incentivize miners (in PoW consensus models)

- to secure the network (in PoS or similar consensus models)

- to hedge against inflation

Rewards are earned through:

- Mining

- Staking and farming

- Running masternodes

- Liquidity exchanges

- Airdrop activities

- etc.

Visit https://www.stakingrewards.com to find a details of allocations to staking, masternodes, mining, and other features for several DeFi projects.

The separated token pool allocated to the team and advisors is organized by signing a Token Option Agreement. This determines the token vesting mechanism (a calendar schedule for the accrual of tokens) and the key performance indicator (KPI). This is an important research check while reviewing Tokenomics. After token vesting is completed, a token lockup is often provided for a certain period to avoid token supply or token demand imbalances. Especially when the employees token becomes liquid and they want to sell the token on Exchanges.

Red Flags 🔗

To conclude our journey, let’s briefly discuss the red flags of tokenomics.

- Unlimited Supply (ceteris paribus).

- Unfair vesting schedule.

- Unfair Token Distribution.

- Inflationary Tokens.

- Possibility of Unwanted changes in the future.

- Non transparent Tokenomics.

- Centralized Mechanisms.

- Non-Optimal token issuance.

- Lack of use cases.

Unlimited Supply could be a strong red flag. We all want to have unlimited assets in our possession such as unlimited internet, food, and so on. In Tokenomics, it’s considered a negative feature.

A token with unlimited supply means that new tokens are always being minted. There’s no measure of token shortage which affect the demand and supply equation. This is because a constant rise in supply would overtake demand leading to a fall in price of the token. More importantly, causes inflation. Worst case scenario is hyper-inflation.

However, the Tokenomics plans of a project with unlimited token supply determines its inflationary and deflationary mechanisms. This is why unlimited supply might be a good fit. Ethereum (ETH) is a good example, with an unlimited token supply. It has burning mechanisms such as EIP-1559. This indicates that a token with an unlimited supply leaves behind a justifiable reason for its action. Dogecoin, a meme coin also has unlimited supply.

It’s important to keep in mind that each project is unique and has its own set of trade-offs and incentives. While some red flags may apply across the board, it’s important to do your due diligence and thoroughly research each project before investing.

Conclusion 🔗

Whether you are considering to invest in an existing coin or looking to build your own, you should be aware of how the markets operate and how to avoid the red flags. The coin must have a utility. Be it for currency or tracking goods/services — it should benefit society.

For further study, consider one of the following books.