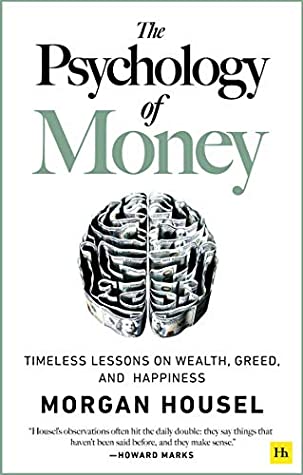

Most of us assume financial success depends on education and intelligence. But in The Psychology of Money, finance expert Morgan Housel presents an alternate hypothesis: The key to financial success lies in understanding human behavior. Housel posits that when you understand how emotions and beliefs influence your financial decisions, you’ll make better financial decisions.

It’s never as good or as bad as it seems 🔗

When looking at your own and other people’s wealth, it’s never as good or as bad as it seems. Focus less on specific individuals as this could warp your view on wealth. The more extreme the wealth of the individual, the more likely this was influenced by luck or risk.

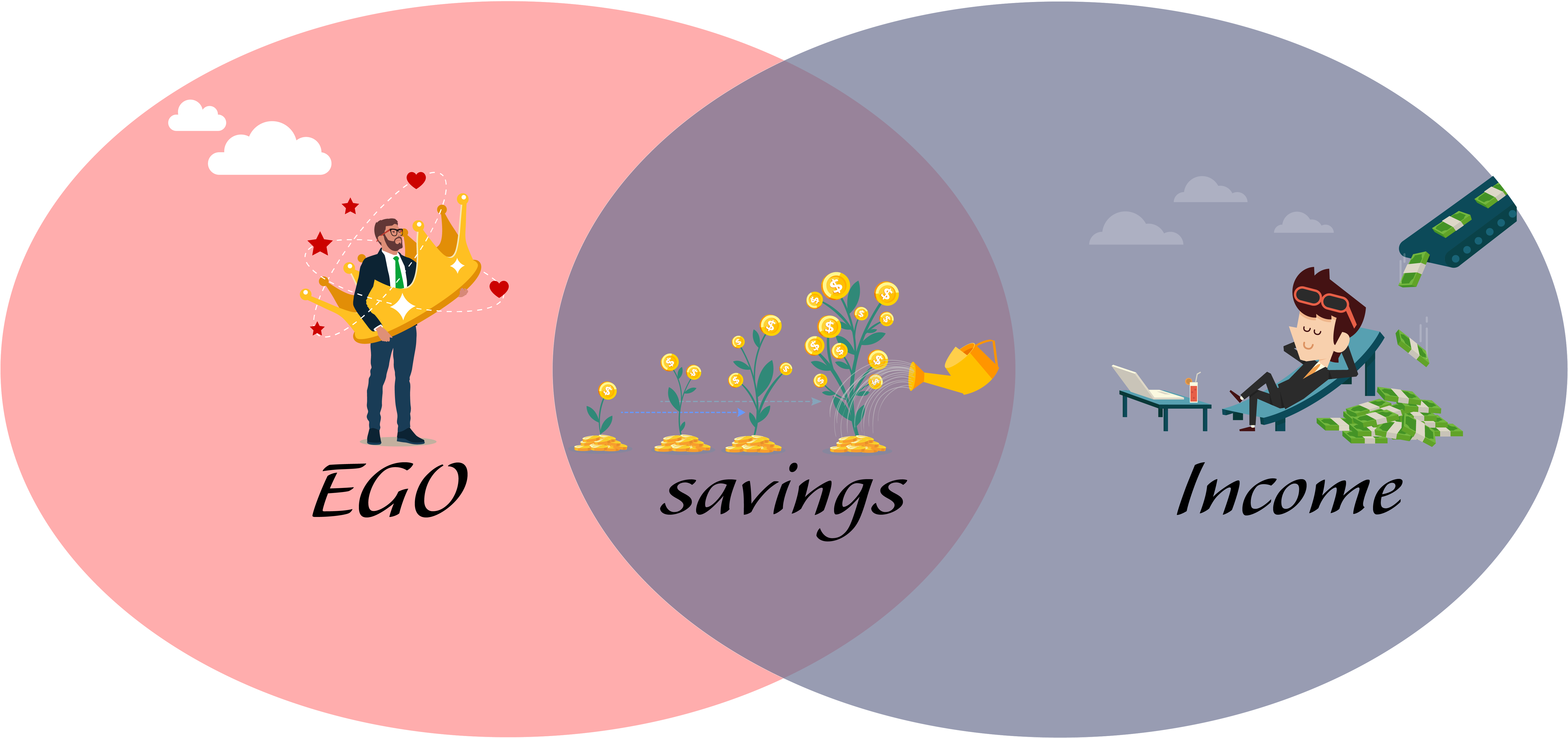

Less ego, more wealth 🔗

There literally is no reason to risk what you have and need for what you don’t have and don’t need. Best to realize that insatiable appetite for more will lead you to regret. Don’t fall for the “status” trap. Better off are the people that dress plainly than those that flaunt their “wealth.”

Wealth is what you don’t see 🔗

Staying wealthy involves a combination of frugality and paranoia. Wealth is the financial assets that haven’t been converted into the stuff you see. The world is full of people who appear rich on social media, but are living on the edge of insolvency and modest people who are actually very wealthy. Furthermore, one may have money but missing health. A healthy body is worth more than any amount of money one could obtain.

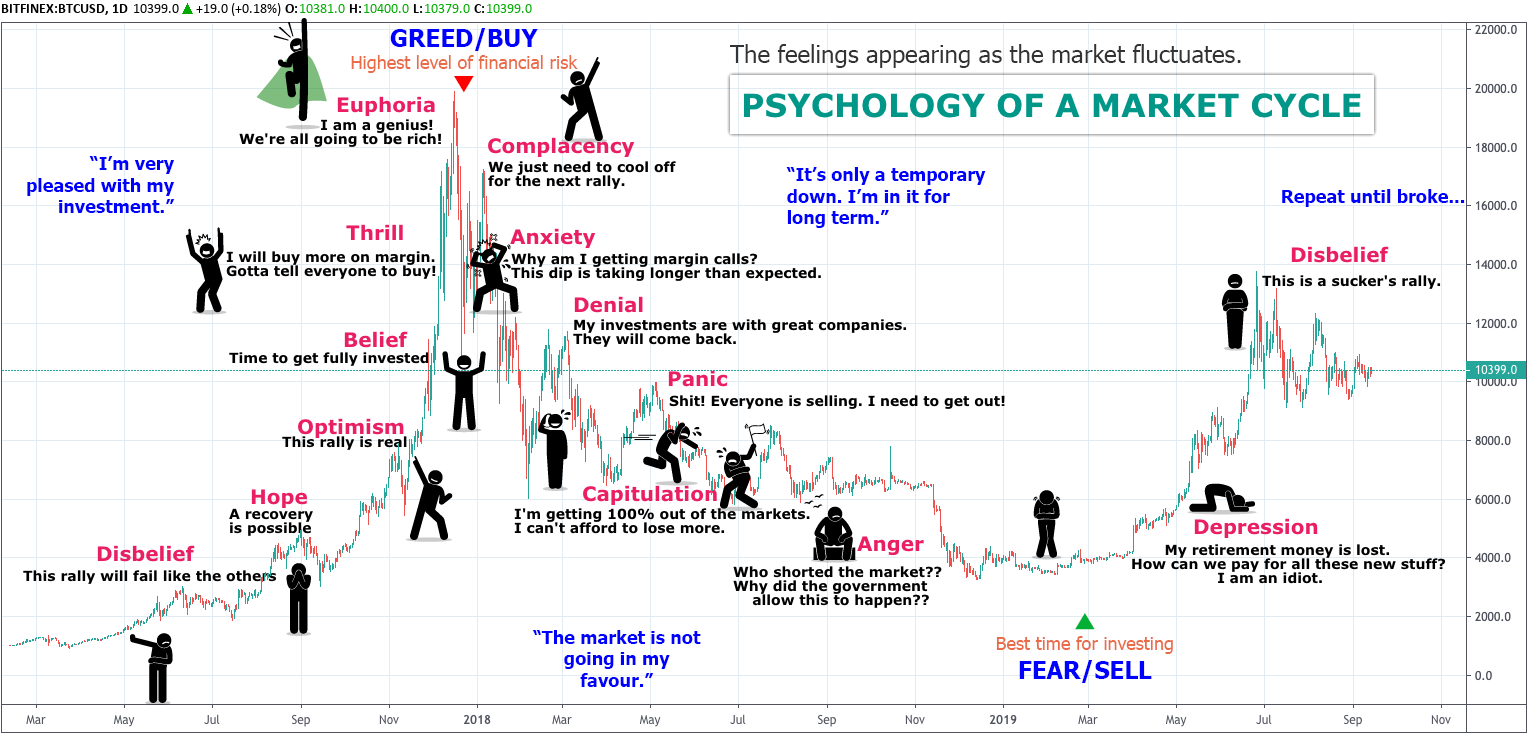

Be comfortable with things not working 🔗

Embrace the realization that things will go wrong. Investments will go wrong but the lessons learned will be invaluable. Look at the overall portfolio and not individual investments to reduce a polarized outlook of progress. Try not to hyper-focus on the bad performers. Cut losses quick and build winners slowly.

Make room for error 🔗

Room for error allows you to take more risks and endure the inevitable highs and lows of the market. It keeps you in the financial game for a longer period of time. Many venture capitalist employ this mindset. They expect that most of their investments will fails with a few winners that more than make up for the losses.

Your financial goals will hit obstacles 🔗

Long term financial planning is imperative to ensure your goals are clear. Life is constantly changing. You might change career. You might have a baby on the way. Perhaps experience a medical event. You might need money for an emergency. We do not know what the future holds or what you will want in 10 years. Accept that your desires are likely to shift.

Avoid the extreme ends of financial planning 🔗

Try to avoid all polarizing extremes. Working yourself to death for a high salary can be detrimental for your health and relationships. On the flip side, not working or having a goal could lead to low income and a lack of financial freedom. On both sides, you will experience regret.

Don’t make yourself a prisoner to your past 🔗

Ahh… the good ol’ sunk cost fallacy. We live in a world where people change drastically over time. Why would you base your present and future goals on decisions you made in the past that no longer serve your best interests? You have the capability to switch banks, partners, careers, locations, anything. Don’t make yourself a prisoner to your past. Furthermore, if the conditions to the old thesis are no longer true, then create a new thesis and plan around all the new information.

Two inevitable things that will affect your life 🔗

Whether you care about them or not, two things will impact your life to a substantial amount — Health + Wealth. The contrast being that health tends to be individualistic while wealth is connected to a global system where one person’s decisions can affect everyone. In the end, it’s better to have health and enjoy a simple life than to be forced to use wealth to repair a broken body.

Changes to the economy 🔗

Progress happens too slow to notice but setbacks happen too quickly to ignore. This could be linked to our animalistic focus on pessimism. Organisms that reacted to threats had a better chance to survive and reproduce. Noticing positive trends doesn’t grab media headlines but the truth is, the world is slowly improving.

Stories are more powerful than statistics 🔗

The more you want something to be true, the more likely you are to believe a story that overestimates the odds of it being true. Stories are the fuel that can enable the tangible parts of the economy to work or something that halts progress.

We have an incomplete view of the world 🔗

We all have an incomplete view of the world. Instead of stating that we don’t know something, we’d rather come up with an explanation based on our unique perspectives and experiences to uncomplicate the world around us. Stories are used to cover our blind spots.

fini 🔗

Money is a challenging topic for many. Reading this book can provide better insights on how you approach money in you life.

Reference 🔗

- 🎥 THE PSYCHOLOGY OF MONEY by Morgan Housel - Core Message | Video 9:48

- 💻 Morgan Housel | @MorganHousel

- 💻 GoodReads.com - ‘Psychology of Money’ by Morgan Housel

Related 🔗